Visitors / Employees

Univest: Local Banking with a Personal Touch

Univest is a relative newcomer to the local financial landscape in Philadelphia, but the regional bank has a long history of serving people and businesses throughout eastern Pennsylvania and New Jersey. Univest opened its doors in Souderton, PA in 1876 as a commercial bank. Regulatory shifts in the late 90s led the company to expand its provision of services and today, they boast insurance, employee benefits, investments, leasing. Univest Bank and Trust Co. has approximately $5.0 billion in assets and $3.6 billion in assets under management and supervision through its wealth management lines of business.

Univest is still headquartered in Souderton, but despite their ongoing expansion and growth, they maintain the ethos and personal touch of a community bank. An outgrowth of their 2015 acquisition of Valley Green Bank, the University City financial center opened its doors in April 2017 with the goal of partnering with residents, students, businesses and institutions across this economically diverse enclave to promote economic growth and access to financial resources. The financial center is staffed by personal bankers which allows customers the convenience of working with one person throughout their entire banking experience. Whether cashing a check, making a deposit or applying for a loan, the personal banker who greets a customer is equipped to help with every banking need.

When asked what makes Univest’s local approach to banking stand out among its competitors, Dana Brown, Executive Vice President of Consumer Banking said, “We’re a regional bank, but we have local decision-making…so if someone comes in to do a loan request the decisions are made no further than Souderton, PA.” Their local focus gives the company first-hand familiarity of the markets that they serve, and an edge when it comes to making deals. According to Brown, “It’s what we do well.”

When asked what makes Univest’s local approach to banking stand out among its competitors, Dana Brown, Executive Vice President of Consumer Banking said, “We’re a regional bank, but we have local decision-making…so if someone comes in to do a loan request the decisions are made no further than Souderton, PA.” Their local focus gives the company first-hand familiarity of the markets that they serve, and an edge when it comes to making deals. According to Brown, “It’s what we do well.”

As one of the fastest growing neighborhoods in Philadelphia and the region, University City offers a unique opportunity for Univest to grow and touch a wide array of community stakeholders, from students, to first-time homebuyers, to under-capitalized small businesses and nonprofits.

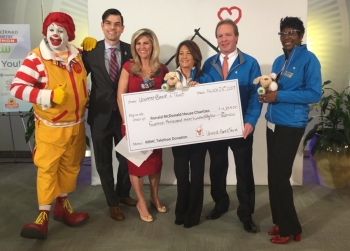

Led by Vice President Michael Laing, each personal banker who staffs the University City financial center was chosen not only for their financial acumen, but also their commitment to community service. That dedication to the neighborhood manifests itself in many ways. The bank donates to local charities, including the ongoing Philadelphia Ronald McDonald House expansion, and they host financial literacy nights in their branch lobby. They also partner with West Philadelphia churches and community groups to bring financial education to people who need it most. Their objective, whether they are presenting to groups of 5 or 50, is to ensure that property owners are financially secure, know the value of their houses and understand how to manage finances.

After two years in University City, Univest continues to seek partnerships that allow them to reach more of the businesses, nonprofits and neighbors who might benefit from their services. Recently, they’ve become the only bank to partner with the Philadelphia Redevelopment Authority’s Restore, Repair, Renew Program—the other lender is a community development nonprofit—which aims to provide low- and middle-income homeowners with low interest loans for home improvements.

Univest is one example how University City businesses--especially our members--put serving people at the heart of their plans for economic growth.